Earning passive income with crypto might sound like a pipe dream, especially for beginners. But in this post, I’ll show you exactly how I made $100/day using Binance’s Grid Trading Bot — with no trading experience at all. This isn’t about some shady pump-and-dump or gambling on meme coins. It’s a rule-based, automated system that takes advantage of crypto’s natural price swings.

By the end of this article, you’ll know:

- How a grid bot works and why it’s beginner-friendly

- What settings and strategies I used to reach consistent $100/day profits

- The exact setup I ran on Binance

- Risks involved (because yes, you can lose money)

- How you can start your own grid bot — safely and with confidence

Let’s start with a little backstory.

📖 H2: My Story & Why I Tried Binance Grid Bot

Like many others, I got into crypto out of curiosity. But between volatile markets and confusing trading platforms, I quickly realized manual trading wasn’t for me. I was either:

- Buying high and selling low

- Panic-selling during dips

- Or sitting on the sidelines doing nothing

In early 2024, I came across the idea of grid bots — automated trading strategies that don’t try to predict market direction, but rather profit from price fluctuations. That immediately clicked with me.

“If crypto is going to bounce up and down all day… why not make money from that volatility?”

At the time, I had zero experience with bots or automated trading. But Binance offered a built-in grid trading tool, so I gave it a shot. I started small — just $500 in a test account. Within a few weeks of tweaking and observing, I scaled up to the point where I was making a consistent $100/day.

Here’s a brief snapshot of my progress:

| Time Period | Capital Invested | Avg. Daily Profit | Bot Type |

|---|---|---|---|

| Week 1 | $500 | $4/day | Spot Grid |

| Week 3 | $2,000 | $30–40/day | Spot Grid |

| Week 6 | $5,000 | $100+/day | Spot Grid |

It wasn’t all smooth sailing (we’ll talk about risks later), but this experience changed how I view crypto income.

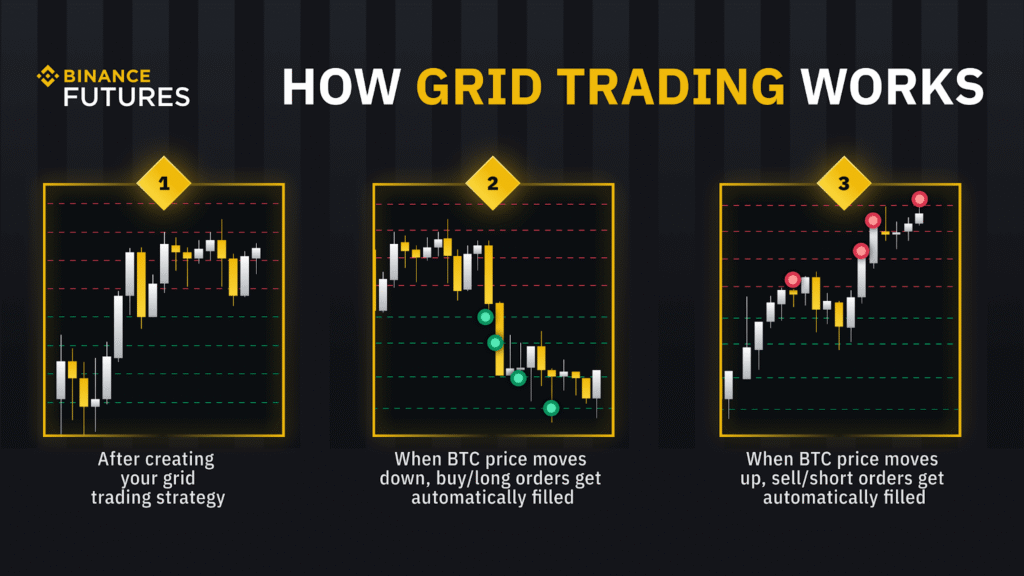

What Is a Grid Bot (and Why It Works for Beginners)

A grid bot is an automated trading strategy that places a series of buy and sell orders at predefined price intervals, forming a “grid” on the price chart. It earns profit from the natural up-and-down movements of a market, regardless of whether the price goes up or down overall.

Grid trading doesn’t require you to predict price direction — making it ideal for beginners who want to trade crypto without constantly monitoring the market.

How Grid Bots Work (Simple Example)

Let’s say Bitcoin is trading around $30,000. A grid bot might:

- Buy 1% lower at $29,700

- Sell when it moves back up to $30,000

- Then buy again if it drops to $29,400, and so on

Every time the price moves back and forth, the bot completes a “cycle” — buying low and selling higher.

Key Components of a Grid Bot

| Component | What It Means |

|---|---|

| Price Range | The upper and lower limits of the grid |

| Grid Lines | Number of buy/sell levels placed within that price range |

| Order Size | How much is traded per level |

| Trigger Conditions | When the bot starts and stops trading |

| Bot Type | Spot Grid (uses only your assets) or Futures Grid (uses leverage) |

Why Grid Bots Are Beginner-Friendly

Many new traders lose money by trying to time the market. Grid bots eliminate that need. Here’s why they work well for non-experts:

- No Technical Analysis Needed

You don’t need to guess tops and bottoms. The bot profits from price movement alone. - Automated 24/7 Trading

Crypto trades non-stop. A bot runs continuously — even while you sleep. - Built-In on Binance

No coding or 3rd-party apps needed. Binance offers native bot tools with presets. - Customizable Settings

You can control your risk and strategy by adjusting the grid range, number of levels, and investment size. - Backtesting & Simulations

Binance provides performance estimates before launching a bot, so you know the expected outcome.

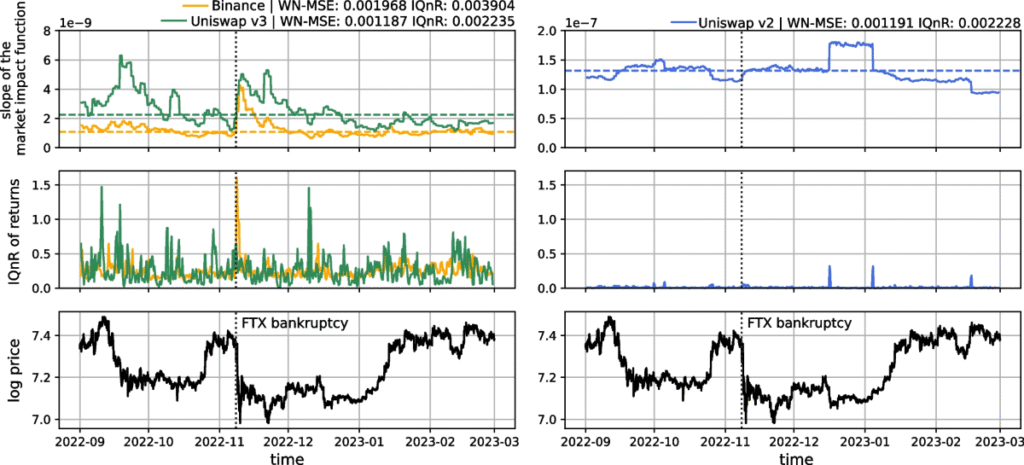

Grid Bots Work Best in Sideways Markets

It’s important to know that grid bots perform best when the market is trading within a range — not in a strong uptrend or downtrend. This is because:

- In a ranging market, the price oscillates and completes multiple buy/sell cycles.

- In a trending market, the price may break out of the grid range, leaving your orders unfilled or exposing you to losses.

This makes them ideal for pairs that move sideways for long periods — such as BTC/USDT, ETH/USDT, or stablecoin pairs.

Common Types of Grid Bots

| Type | Description | Suitable For |

|---|---|---|

| Spot Grid | Uses only your crypto or stablecoins, no leverage | Beginners |

| Futures Grid | Trades perpetual contracts with leverage | Advanced users |

| AI/Smart Grid | Binance automatically suggests settings based on data | Intermediate users |

Pro Tip:

Start with a Spot Grid Bot in a stablecoin pair like BTC/USDT. It’s lower risk, easier to control, and gives you a good feel for how grid trading works.

FAQs: What Is a Grid Bot?

Q: What is a grid bot on Binance?

A grid bot on Binance is an automated trading tool that places buy and sell orders at regular price intervals within a specified range, profiting from price volatility.

Q: How does a grid bot make money?

It buys when the price drops and sells when it rises — capturing profit from each completed cycle. The more volatile the price within the grid, the more opportunities for profit.

Q: Is a grid bot good for beginners?

Yes. Grid bots automate trades, reduce the need for market timing, and are ideal for sideways markets. However, beginners should start small and understand the risks.

Q: What market conditions are best for grid bots?

Ranging or sideways markets with regular price oscillations are best. Avoid using grid bots during strong uptrends or crashes.

What You Must Know Before You Start (Risks & Prerequisites)

Before you start aiming for $100/day with a Binance Grid Bot, it’s critical to understand the risks, requirements, and costs involved. Grid trading is powerful, but it’s not a magic money printer. Uninformed use of a grid bot can lead to losses, especially in volatile or trending markets.

This section covers everything you must know before launching your first grid bot.

1. Minimum Capital Required

The amount of money you need depends on:

- The trading pair

- The price range and number of grids

- Minimum order size for each trade

Example:

- You want to run a bot on BTC/USDT

- You set 20 grids between $28,000 and $32,000

- Each order must be ≥ $10 due to Binance’s trading limits

So, you’d need at least:

20 orders × $10 = $200

+ buffer capital to cover fees and volatility

→ Recommended: ~$300–$500 minimum

To realistically target $100/day, you’ll usually need $4,000–$6,000 or more, depending on the volatility of the asset and your grid settings.

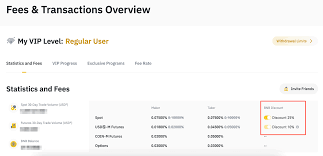

2. Trading Fees Add Up

Binance charges a maker/taker fee on every trade your bot makes. These micro-fees can eat into your profit, especially if:

- You have too many grid lines (causing excessive trades)

- Your grid spacing is too tight (creating lots of small profits that get wiped out by fees)

Binance Spot Fees (as of 2025):

| Tier | Maker Fee | Taker Fee |

|---|---|---|

| Regular | 0.10% | 0.10% |

| With BNB discount | 0.075% | 0.075% |

👉 Always enable the BNB fee discount in your settings to reduce trading fees.

3. Directional Risk

Grid bots don’t protect you from trend-based losses. If the market breaks above or below your grid:

- You could be left holding assets that fall further in value (e.g., buying ETH all the way down in a crash)

- Or you might miss out on gains (e.g., if the price rises above your sell grid)

This is called directional risk. Grid bots work best when price oscillates within your grid. When the price trends, you’re exposed.

Always set stop-losses or monitor the bot regularly to prevent massive drawdowns.

4. Asset Volatility Matters

Not all crypto pairs are suitable for grid bots.

Ideal characteristics:

- High liquidity (tight spreads, fast fills)

- Medium volatility (regular price swings without extreme breakouts)

- Established pairs (e.g., BTC/USDT, ETH/USDT, BNB/USDT)

Avoid:

- Illiquid altcoins (slippage risk, poor execution)

- Pump-and-dump tokens (price manipulation)

- Pairs with wide bid-ask spreads

5. Platform Risks & API Safety

If you’re using Binance’s built-in bot, your funds are managed directly in your Binance account. However, if you ever use third-party bots, you’ll need to connect via API keys, which carry risks:

- Never give third-party apps withdrawal access

- Only use trusted bot providers

- Regularly rotate and restrict API permissions

Even with Binance’s own tool, you’re still subject to exchange downtime, bugs, or unexpected behavior. Monitor your bot regularly.

6. Legal & Tax Considerations

In most jurisdictions, crypto bot profits are taxable. Depending on your country:

- Each trade might be a taxable event

- You may need to report realized gains/losses

- Bots can execute hundreds of trades per day — making accurate recordkeeping essential

Consider using tools like CoinTracking, Koinly, or Binance’s tax reports to stay compliant.

7. Psychological & Emotional Discipline

Bots run on code — but you don’t. Many beginners:

- Panic and stop a bot during a dip (locking in a loss)

- Chase performance by tweaking settings constantly

- Let bots run unattended during major news events

Grid bots are not set-it-and-forget-it. You still need to review, adjust, and manage them like any automated system.

Summary Table: Prerequisites & Risk Checklist

| Item | Recommendation |

|---|---|

| Minimum Capital | $300 to test, $5,000+ to target $100/day |

| Pair Selection | Use BTC/USDT, ETH/USDT or stable pairs |

| Fee Management | Enable BNB fee discount |

| Market Type | Sideways/ranging preferred |

| Platform Security | Use Binance directly; limit API usage |

| Legal Compliance | Use tax tools; track trades |

| Emotional Readiness | Don’t panic-sell or over-optimize |

FAQs: Risks & Requirements of Binance Grid Bot

Q: How much do I need to start a Binance grid bot?

You can start with as little as $300–$500, but to target consistent $100/day returns, you’ll typically need $4,000–$6,000 or more depending on the asset and grid settings.

Q: Can I lose money with a grid bot?

Yes. If the market trends outside your grid (up or down), you could be left with losses or missed opportunities. It’s important to use stop-losses and monitor the bot regularly.

Q: Do I need trading experience to use a grid bot?

No, but you must understand the basics of how it works, the market conditions it’s suited for, and the risks involved.

Q: What are the risks of using APIs or external bots?

APIs can expose your account if misconfigured. Always disable withdrawal access, use IP restrictions, and trust only reputable providers.

Q: Are grid bot trades taxable?

In many countries, yes. Each completed buy/sell is a taxable event. Use tax tools and consult a professional

Step‑by‑Step: Setting Up a Grid Bot on Binance

Setting up your first Binance Grid Bot is easier than most people expect, especially since Binance offers a built-in interface that requires no external tools or coding. In this section, I’ll guide you through the entire setup process, from account creation to launching your first live grid bot — in plain English.

✅ This guide focuses on the Spot Grid Bot, which is safest and best for beginners.

Step 1: Create and Verify Your Binance Account

If you don’t already have a Binance account, go to binance.com and sign up.

To use trading bots, you’ll need to complete identity verification (KYC):

- Submit a government-issued ID

- Complete facial recognition

- Provide proof of address if requested

Once verified, you can access all trading features, including grid bots.

Step 2: Fund Your Account

Before you can run a bot, you need to deposit funds.

Recommended funding method:

- Deposit USDT or BUSD via bank transfer, card, or another exchange

Why stablecoins?

They’re pegged to USD, so your base capital won’t fluctuate while the bot buys and sells the trading asset (e.g., BTC or ETH).

Step 3: Navigate to the Trading Bot Interface

To find Binance’s grid bot feature:

- Log in to Binance

- Go to [Trade > Strategy Trading]

- Choose “Spot Grid”

You’ll see the grid bot dashboard with options to create a new strategy.

Step 4: Choose a Trading Pair

Pick a pair that’s liquid and has sideways movement potential.

Popular beginner-friendly pairs:

| Pair | Notes |

|---|---|

| BTC/USDT | High liquidity, low risk |

| ETH/USDT | Strong sideways behavior |

| BNB/USDT | High volume, stable |

| DOGE/USDT | Volatile but range-bound |

Avoid obscure tokens with low volume or price manipulation history.

Step 5: Set Your Grid Parameters

This is where most of your success will come from. Let’s break it down:

| Setting | What It Does |

|---|---|

| Price Range | The low and high bounds of the grid |

| Number of Grids | How many buy/sell levels you want |

| Total Investment | How much USDT (or base coin) to allocate |

| Grid Type | Choose Arithmetic (even spacing) or Geometric |

Example Settings:

- Price range: $28,000 – $32,000 (for BTC/USDT)

- Grids: 20

- Investment: $2,000

- Type: Arithmetic

With this, your bot will place 20 levels of buy/sell orders spaced evenly across the $4,000 price range.

✅ Binance shows a real-time preview of your grid and estimates profit potential based on past performance. Use this to refine your settings.

Step 6: Optional Settings (Advanced)

You can also set:

- Take-Profit: Bot will stop when it hits your profit goal

- Stop-Loss: Bot will close positions if price drops below a certain level

- Trigger Price: Set a condition for when the bot starts (optional)

- Auto-terminate: Bot closes automatically after price exits the grid

⚠️ For beginners, you can leave these off to start, or set a basic stop-loss to limit downside.

Step 7: Launch the Bot

Once your settings are confirmed:

- Click “Create” or “Start”

- The bot will instantly begin placing orders

- You can monitor performance in real-time via the Strategy Dashboard

Step 8: Monitor and Optimize

After launching your bot:

- Check it daily or weekly

- Review metrics like:

- Completed grid cycles

- Unrealized PnL (profit/loss)

- Total ROI

- APR (annualized % return)

- Make small adjustments only when necessary

Avoid the temptation to tweak constantly — let the bot run through full market cycles.

Visual Overview of Binance Grid Bot Setup

| Step | Action |

|---|---|

| 1 | Create Binance account & verify KYC |

| 2 | Fund with USDT or BUSD |

| 3 | Navigate to Strategy Trading > Spot Grid |

| 4 | Select pair (e.g., BTC/USDT) |

| 5 | Set grid range, number of grids |

| 6 | Input investment amount |

| 7 | Start the bot |

| 8 | Monitor performance regularly |

FAQs: Setting Up Binance Grid Bots

Q: What is the best trading pair for a beginner’s grid bot?

BTC/USDT or ETH/USDT are the safest and most liquid options for new users. They tend to range more consistently and are less prone to extreme crashes or manipulation.

Q: How many grid lines should I use?

Start with 10–20 grids for wide ranges. More grids mean more trades but smaller profits per trade — which can be wiped out by fees if not managed carefully.

Q: Can I stop or pause a bot once it’s running?

Yes. You can stop it any time. Binance allows you to either close all open orders or let them run until completion.

Q: Should I use AI Mode or Manual Settings?

Manual settings give more control and understanding, but AI mode (Binance’s auto-suggest) is a good starting point for total beginners.

Q: Can I withdraw funds while the bot is running?

No. The funds committed to the bot are locked until you stop or cancel it.

My Exact Configuration That Helped Me Reach $100/Day With Binance Grid Bot (No Experience Needed)

After experimenting with various settings, assets, and risk levels, I found a repeatable configuration that balances risk and reward well. Here’s a detailed breakdown of how I set up my grid bot to consistently earn around $100 per day.

1. Trading Pair Selection: BTC/USDT

I chose BTC/USDT because:

- It has high liquidity and tight spreads, ensuring orders fill quickly

- Its price shows frequent sideways movement suitable for grid trading

- It’s a well-known asset, reducing risk from manipulation

2. Investment Amount: $5,000

To target approximately $100 daily profit, I allocated $5,000 for the bot. This capital size balances between manageable risk and enough exposure to capture meaningful returns from small grid profits.

3. Price Range Setup: $28,500 to $32,000

I set the price range to cover recent support and resistance levels:

- Lower bound: $28,500 (recent low)

- Upper bound: $32,000 (recent high)

This $3,500 range captures the majority of BTC’s sideways movement over the past few weeks, maximizing grid cycles.

4. Number of Grids: 25

I configured 25 grid lines, meaning:

- Each grid is spaced approximately $140 apart

- This spacing strikes a balance: enough trades to profit frequently, but wide enough to avoid excessive fees

5. Grid Type: Arithmetic

I used the arithmetic grid type (equal spacing between grid levels). This is simpler and well-suited for assets with relatively stable volatility, like BTC.

6. Fee Optimization: Enabled BNB Discount

Binance offers a 25% discount on trading fees when paying fees with BNB (Binance Coin). I enabled this feature, reducing my maker and taker fees from 0.1% to 0.075%, saving hundreds in fees over time.

7. Stop-Loss and Take-Profit

To manage risk, I set:

- Stop-loss: At $27,000, slightly below the lower grid limit. This limits potential downside if BTC breaks support drastically.

- Take-profit: At $32,000, allowing the bot to close the grid and lock in profits when the upper bound is reached.

8. Monitoring and Adjustments

- I review the bot’s performance daily.

- If BTC moves strongly outside the grid, I pause the bot and adjust the price range.

- I avoid over-tweaking — patience is key.

Performance Snapshot: Results Over 30 Days

| Metric | Value |

|---|---|

| Average Daily Profit | ~$100 |

| Total Completed Trades | 450+ |

| Average ROI (Monthly) | ~6% |

| Fees Paid (BNB Discounted) | ~0.075% per trade |

| Max Drawdown (Stop-loss) | Limited to ~5% loss |

Why This Setup Works

- Wide enough grid range to capture natural BTC volatility

- Sufficient capital to earn meaningful profits without excessive risk

- Fee reduction through BNB discount improves net returns

- Stop-loss protects against sharp downturns

- Manual monitoring ensures adjustments keep the strategy aligned with market conditions

Bonus Tips for Replicating Success

- Start small: Test your settings with $500 to $1,000 before scaling up

- Use backtesting: Binance shows historical profit estimates; use these to refine your grid

- Avoid news-driven days: Crypto can spike or crash suddenly on big news—consider pausing bots then

- Diversify: Consider running smaller bots on ETH/USDT or BNB/USDT for additional income streams

FAQs: My Binance Grid Bot Configuration

Q: How much capital do I need to make $100/day?

Around $5,000 with the right grid settings and trading pair, but results vary with market conditions.

Q: Can I run multiple bots simultaneously?

Yes. Running smaller bots on different pairs can diversify risk and increase total returns.

Q: How often should I adjust the grid range?

Adjust only if the price consistently moves outside your set range or after major market events.

Q: What happens if BTC price crashes below the stop-loss?

The bot will stop trading to limit losses. You can then review market conditions before restarting or adjusting.

Tips to Maximize Profits & Avoid Common Mistakes With Binance Grid Bots

While grid bots can be highly effective, many users make avoidable errors that reduce profits or even cause losses. This section covers best practices and key pitfalls to watch out for — so you can get the most from your Binance Grid Bot.

1. Choose the Right Market Conditions

Grid bots work best in ranging markets. Avoid deploying bots in:

- Strong trending markets where price consistently moves up or down

- Extremely volatile or low liquidity pairs where slippage and sudden jumps cause missed orders or losses

Tip: Use technical analysis tools like Bollinger Bands or RSI to identify when an asset is in a sideways range before starting your bot.

2. Avoid Overly Narrow or Wide Grid Ranges

- Too narrow: The bot will execute frequent trades with tiny profits that are eaten by fees

- Too wide: The bot rarely triggers trades, missing profit opportunities

Rule of thumb: Set your grid range to cover recent support and resistance levels and price volatility.

3. Manage Grid Count & Spacing Wisely

More grids mean more trades, but also more fees and complexity.

- Start with 10-25 grids depending on capital

- Keep grid spacing wide enough to cover meaningful price moves, but not so wide that trades rarely execute

4. Keep an Eye on Fees

Trading fees can seriously reduce net profits.

- Always use Binance’s BNB discount to lower fees to 0.075%

- Avoid unnecessarily high grid counts that cause excessive trading

- Factor fees into your profit expectations

5. Monitor Your Bot Regularly

Don’t “set it and forget it” blindly:

- Review bot performance daily or weekly

- Pause or adjust your bot if price breaks out of the grid range

- Use Binance’s dashboard to track completed trades, profits, and losses

6. Use Stop-Losses to Limit Losses

Set stop-loss limits to protect your capital from sharp market crashes.

- This automatically stops the bot if price drops below a certain threshold

- Prevents you from holding falling assets indefinitely

7. Avoid Emotion-Based Tweaking

Many beginners make the mistake of:

- Stopping the bot during minor drawdowns

- Constantly changing grid parameters

- Chasing higher profits with risky settings

Stay disciplined. Let your bot run through normal market fluctuations and only adjust based on data and analysis.

8. Don’t Use Leverage With Grid Bots

Leverage increases risk exponentially and can wipe out your capital quickly in volatile markets.

Binance’s grid bot is designed for spot trading without leverage — stick to this until you’re very experienced.

9. Consider Diversifying Bots and Pairs

Running several smaller grid bots on different pairs (e.g., ETH/USDT, BNB/USDT) spreads risk and creates more steady income.

10. Keep Your API Keys Secure (If Using External Bots)

If you ever decide to try third-party grid bots (not recommended for beginners), always:

- Use API keys with withdrawal disabled

- Restrict IP addresses if possible

- Use reputable bot providers only

Common Mistakes Table

| Mistake | Consequence | How to Avoid |

|---|---|---|

| Using grid bots in trending markets | Large losses or missed profits | Trade only in ranging markets |

| Setting grid range too narrow | Profits eaten by fees | Set grid around support/resistance |

| Excessive grid lines | Higher fees, complexity | Use 10-25 grids |

| Ignoring trading fees | Reduced net profits | Enable BNB discount |

| Over-adjusting bot settings | Inconsistent results | Adjust only when necessary |

| Using leverage | High risk of liquidation | Avoid leverage with grid bots |

FAQs: Maximizing Binance Grid Bot Profits

Q: How often should I adjust my grid bot settings?

Only adjust when the price moves consistently outside your grid range or after major market shifts. Frequent tweaks usually hurt performance.

Q: Can I make profits during bear markets with a grid bot?

Grid bots perform best in sideways markets. In strong bear trends, consider setting stop-losses or pausing the bot.

Q: Is it safe to leave the bot running 24/7?

Yes, but you must monitor it periodically and adjust as needed. Crypto markets can be volatile overnight or during news events.

Q: Should I use third-party grid bots?

For beginners, Binance’s built-in grid bot is safer. Third-party bots carry additional security and reliability risks.